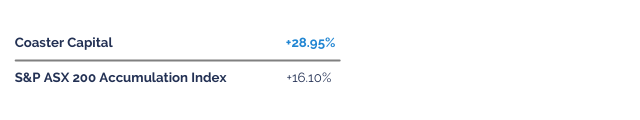

Coaster is an investment management boutique founded in 2019 in the business of maximising absolute investment returns, rather than building AUM. Our focus is concentrated on the investment experience of our people and the alpha available to their strategy. That is our primary consideration and everything follows from there.

Why choose us?

The firm was established with a goal to design, develop, and manage a selection of exclusive, high-performing funds, with limited capacity. Importantly, the firm is 100 percent owned by our executive team who are invested alongside our clients in Coaster’s funds.

We seek to build hedge funds that leverage our specific areas of expertise and track records. We are focused on investing in areas where there is the opportunity for enduring alpha generation, and on working with experts that have demonstrated their ability over different business and market cycles.

The Dorado Fund is an Australian listed resource sector focused equity long short strategy, with potential for significant long-term capital growth with less correlation or drawdowns typically related to long only resource stock investments.

The Arrow Fund is an Australian focused equity long short strategy, offering investors potential significant long-term returns uncorrelated to other markets.

From online applications to portfolio manager access, we provide our investors institutional grade service and support, but with the terms and performance of smaller, more agile funds.

Arrow Fund and Dorado Fund are available to eligible investors. If you are unsure or to confirm your eligibility to invest please contact Coaster Capital on +61 7 3039 0001